Kickstarting Your Customer-Centric Journey with Theta’s Customer-Base Audit

November 21, 2024

In our previous post, we explored how Customer-Base Audit (CBA) provides valuable insights to investors during due diligence, offering a more comprehensive understanding of customer dynamics than traditional financial methods alone. But CBA is not just a tool for investors – there is an equally large value creation opportunity for corporations. In this post, we explore how a systematic “audit” of customer behavior can help corporations set the foundation for long-term, customer-centric growth.

Moving Beyond Traditional Metrics

Most companies have an exceptionally good understanding of their traditional financials: segment-level P&L reports, monthly flash forecasts for revenue, revenue and profit variance analyses, and much more are commonplace. Yet, few can confidently answer critical questions about the customers driving those numbers. How did one-time buyers contribute to last year’s revenue? What proportion of your new customers make a second purchase within a few months? These questions form the backbone of understanding true customer health. We have found that while most executives have revenue and profit numbers at their fingertips, they are completely unaware of these customer-based metrics (are you?).

A Customer-Base Audit brings these questions to the forefront by offering a descriptive, data-driven view of customer behavior. CBA digs deep into historical transaction data, examining customer behavior through five different lenses. This helps businesses gain a clear, diagnostic understanding of customer activity, which serves as a foundation for becoming truly customer-centric.

Five Lenses of the Customer-Base Audit

The Customer-Base Audit was first introduced as “a systematic review of the buying behavior of a firm’s customers using data captured by its transactional systems” in The Customer-Base Audit book by Theta’s co-founder Peter Fader and his co-authors, Bruce Hardie and Michael Ross. It slices the customer base transactions using five different lenses:

- Lens 1: How Different Are Our Customers? Analyzes active customers by key profit drivers (e.g., frequency of transactions, average order value, and margin) to start to reveal pockets of opportunity through the “long tail” of the customer base.

- Lens 2: What Has Changed Over Time? Tracks shifts in customer activity and profit drivers to get a directional sense of overall customer health dynamics.

- Lens 3: How Does Customer Cohort Behavior Evolve? Observes customer lifecycle patterns and retention by tracking spending, transactions, and engagement metrics within a given acquisition cohort.

- Lens 4: How Do Cohorts Compare Over Time? Compares behaviors across cohorts to understand whether newly acquired customers are trending in the right direction and the underlying profit-driver explanations of these cross-cohort dynamics.

- Lens 5: How Healthy Is Our Customer Base? Zooms out to the overall customer base, using Customer Cohort Charts (see our previous post on this topic) to visualize the full set of dynamics within and across cohorts. By combining perspectives from the full set of lenses, this view offers clear diagnostics about the profitability profile for the entire enterprise.

Examples of CBA Analyses

Let’s take a look at a few examples of the insights a CBA can provide. We use real data from real diligence for the analysis that follows.

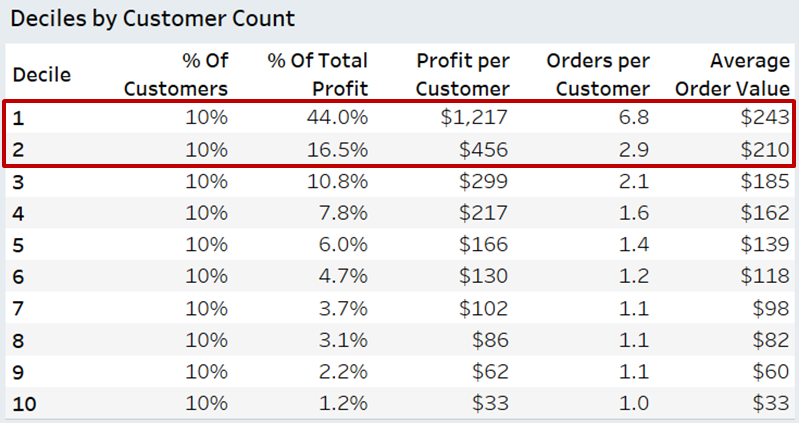

By segmenting the customer base using Lens 1 (“How Different Are Our Customers?”) into deciles based on generated profit, a CBA can highlight that, for instance, the top 20% of customers contribute 60% of the profits, indicating a need to better understand who these best customers are and to prioritize retention and development efforts around this segment. Note that, in this case, profits did not account for CAC. Accounting for CAC, the share of profits attributable to the top 20% of the most profitable customers will likely be higher.

It would also uncover significant differences across the customers. In the example below, the top 10% of customers have almost 7x higher order frequency and average order value than the bottom 10%. Leveraging these differences is a key step in your customer-centric strategy.

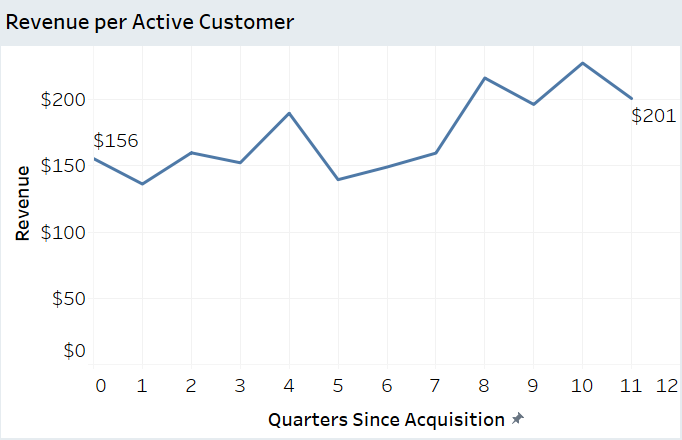

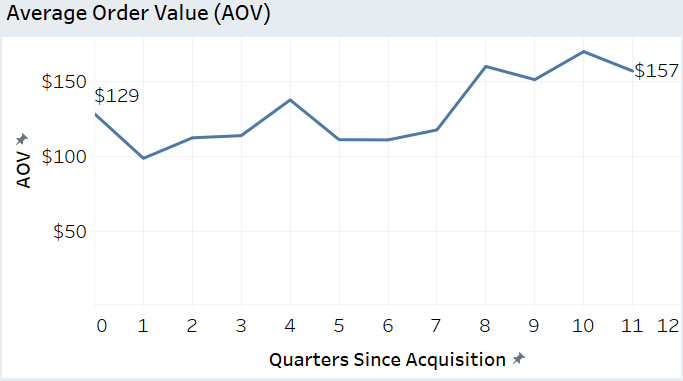

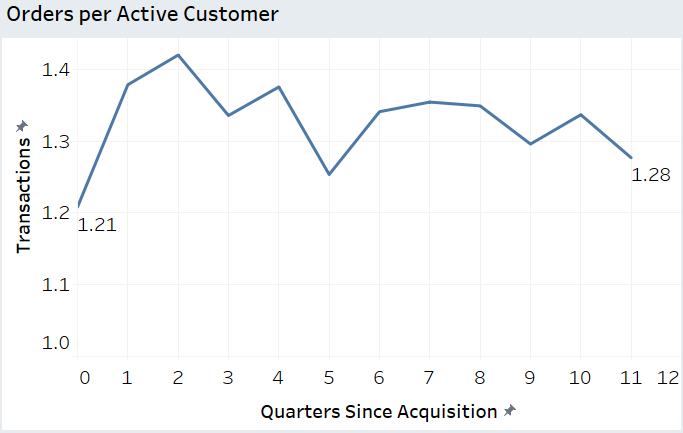

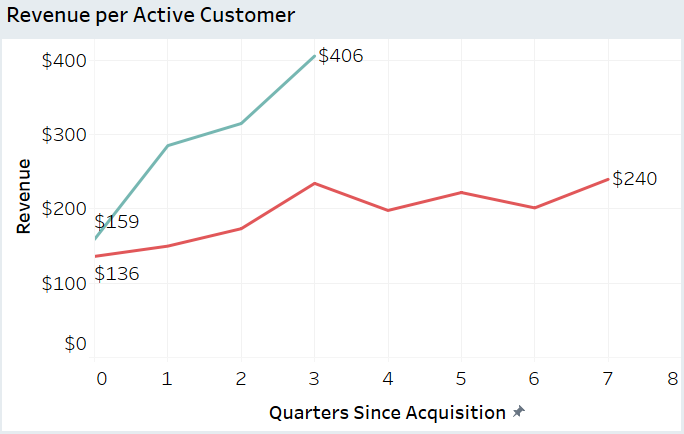

Another example illustrates how Lens 3 (“How Does Customer Cohort Behavior Evolve?”) can help uncover issues within the seemingly healthy behavior of a company’s customers. In this case, we use Lens 3 to track the revenue per active customer for a cohort acquired in Q4 2021. At first glance, the behavior appears healthy – the average revenue per active customer trends upward, although with some fluctuations.

However, by decomposing this revenue into average order value (AOV) and the average number of orders per customer, a CBA would reveal that the growth is driven solely by AOV, while the cohort’s repeat purchasing behavior has actually declined after the first two quarters post-acquisition. As such, while revenue per active customer is up, it is because prices are moving up enough to cause people to buy less often when they do buy. This begs many customer-centric questions: what is causing prices to move up, what the relationship is between price and unit demand, and more.

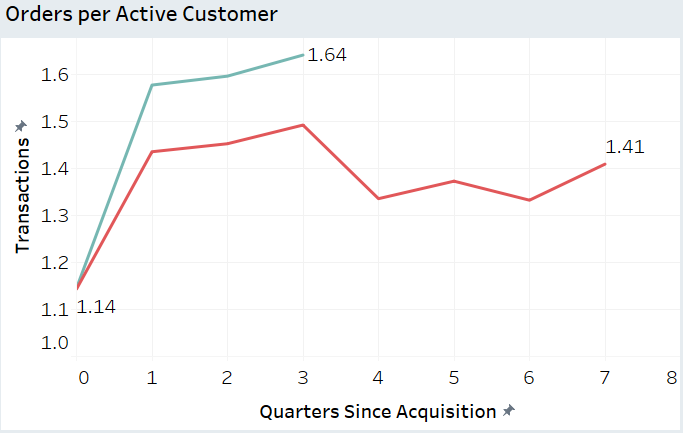

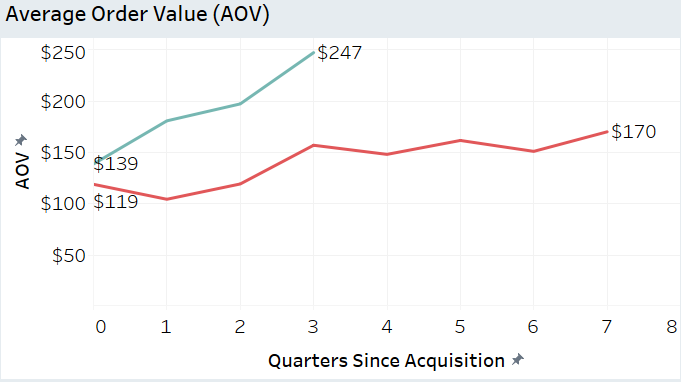

In this example of using Lens 4 (“How Do Cohorts Compare Over Time?”), we compare the behavior of the cohort of customers acquired in Q1 2023 (red line) with that of customers acquired one year later, in Q1 2024 (teal line). The newer cohort significantly outperforms the older one in both AOV and repeat purchasing, prompting the company to reflect on what was done differently (e.g., a specific marketing campaign or a new acquisition channel) and how to continue acquiring customers like these. This is a very good sign – the company is acquiring more valuable customers now than they were, so identifying what factors might be contributing to this and doubling down on those factors could help perpetuate this positive dynamic.

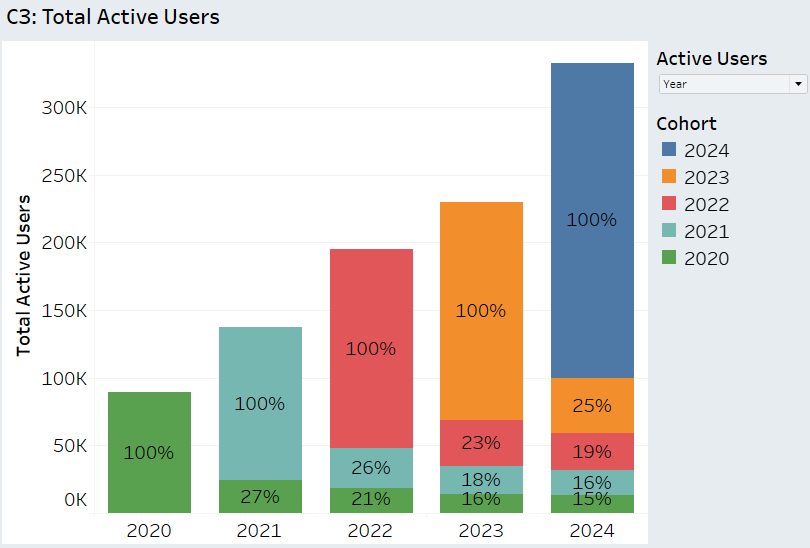

Lens 5 (“How Healthy Is Our Customer Base?”) integrates insights from all other lenses to offer a holistic view of customer cohorts over time using Customer Cohort Charts (C3). For example, the chart below shows the total number of active customers (those who made at least one purchase in a given calendar year) segmented by their acquisition year (cohort). Each bar represents the total active users each year, broken down by the contribution of each cohort. The percentages indicate the share of customers from a specific cohort who remained active in subsequent years.

For instance, the red segment (representing the 2022 cohort) is shown as 100% in 2022, as all customers in this cohort were acquired and active in that year. By 2023, 23% of the 2022 cohort remained active, and this figure decreased to 19% by 2024. The chart effectively illustrates cohort retention trends and the overall composition of active customers over time.

This chart provides a number of critical insights:

- The active customer base growth is largely driven by an influx of new customers rather than increased spending from existing ones – about 75% of all active customers every year are new customers. Observing the C3, we see that this is due to highly effectively customer acquisition, uncovering that customer acquisition will likely be a very important driver of the success of the company in the years to come. As such, significant organizational focus should be placed on continuing to acquire customers effectively (e.g., top of funnel initiatives, programs designed to expand the applicable market, investments into salesforce efficiency, and early identification of top performing acquisition channels).

- About 75% of newly acquired customers drop out after the first year. Whether a 75% year-one customer activity “churn rate” is a lot or a little depends on the nature of the business and competitive benchmarks – we cannot divulge more about this business to draw these sorts of normative conclusions here, but we could (and often do) make these sorts of competitive benchmarking insights available to you as part of a formal engagement.

- After the initial drop-off, the customer base stabilizes, remaining at around 15% after four years (see the 2020 cohort). These customers represent the loyal core of the customer base, and the company should take a closer look to understand who they are, what they need, and how to acquire more customers like them.

Putting It into Practice

A Customer-Base Audit is a powerful way for corporations to kickstart their journey towards data-driven customer decision-making and customer centricity. Many organizations struggle to understand the true health of their customer relationships, often focusing solely on top-down financial metrics, with segmentation often limited to geographies or product lines. By diving deep into customer data, CBA offers a fundamental understanding of customer behavior, shedding light on how customers contribute to revenue and profit. This initial audit serves as a catalyst for a customer-centric transformation, enabling companies to move from mere aspirations of customer focus to real, data-driven strategies.

- A company’s CEO can use the results of a CBA analysis to plan the journey to customer-centricity. One of the key insights from a Customer-Base Audit is understanding the long-term profitability of different customer groups and how they contribute to the value of the enterprise as a whole – this is exactly the sort of high-level strategic insight that the CEO needs.

- A CMO can use it to refine customer retention strategies. By breaking down revenue contributions and cohort behavior, corporations can identify declining engagement and retention early on. This insight is essential for designing and implementing interventions that turn at-risk customers into loyal, repeat buyers.

- Corporate development teams can use CBA as part of their due diligence toolkit for M&A or investment decisions to gain a deeper understanding of the health of the target company’s customer base.

The key advantage of a Customer-Base Audit is its simplicity. It doesn’t require sophisticated predictive models or artificial intelligence – instead, it uses historical data to tell an actionable story about your customers, and as such, does so at lightning fast speed. By answering fundamental questions about customer acquisition, retention, and behavior over time, a CBA empowers leaders to understand what drives the firm’s success. For corporations looking to take their first steps towards customer-centricity or to refine their existing customer strategies, a CBA is an indispensable tool.

Are you ready to take the first steps in building a customer-centric organization? Contact us today to learn more about how a Customer-Base Audit can reveal actionable insights about your customers.