Theta’s Customer-Base Audit: Rapid and Cost-Effective Due Diligence Tool

November 7, 2024

In a previous post, we discussed the importance of using a customer lens in private equity due diligence alongside the more traditional financials-based approach. Traditional due diligence often focuses on balance sheets and top-down growth forecasts but misses a critical aspect: the true health of a company’s customer base. A customer-focused approach, on the other hand, allows investors to uncover the underlying drivers of revenue, providing a clearer view of a company’s financial strength, sustainability, and growth potential – insights that are essential for assessing the long-term value of an investment.

Theta was built around one of the most powerful customer-centric tools for private equity due diligence: a Customer Lifetime Value (CLV) based view of the company’s customer base. This tool allows investors to project future revenue streams and profits by understanding and forecasting underlying behaviors such as retention, repeat purchasing, and spend per order. With a CLV-focused analysis, investors gain a clear, forward-looking picture of the company’s growth and profitability potential, ensuring they put capital into opportunities with maximum ROI.

The Customer-Base Audit

However, not every deal allows for this comprehensive, forward-looking analysis due to time or budget constraints, especially in the early stages of due diligence. In these cases, a Customer-Base Audit (CBA) offers an efficient way to evaluate customer health, identify trends in customer behavior, and gain a granular view of underlying drivers using purely historical customer data – no forecasting models at all. By leveraging a CBA, investors can develop a solid understanding of customer dynamics to inform their decisions about whether or not the company’s customer base will support continued growth and profitability. Although purely descriptive, CBA analysis provides excellent value, balancing speed, cost, and insights.

The Customer-Base Audit was first introduced as “a systematic review of the buying behavior of a firm’s customers using data captured by its transactional systems” in The Customer-Base Audit book by Theta’s co-founder Peter Fader and his co-authors, Bruce Hardie and Michael Ross. It slices the customer base transactions using five different lenses:

- Lens 1: How Different Are Our Customers? Analyzes active customers by key profit drivers (e.g., frequency of transactions, average order value, and margin) to start to reveal pockets of opportunity through the “long tail” of the customer base.

- Lens 2: What Has Changed Over Time? Tracks shifts in customer activity and the profit drivers to get a directional sense of overall customer health dynamics.

- Lens 3: How Does Customer Cohort Behavior Evolve? Observes customer lifecycle patterns and retention by tracking spending, transactions, and engagement metrics within a given acquisition cohort.

- Lens 4: How Do Cohorts Compare Over Time? Compares behaviors across cohorts to get a sense of whether newly acquired customers are trending in the right direction and the underlying profit-driver explanations of these cross-cohort dynamics.

- Lens 5: How Healthy Is Our Customer Base? Pulls back to the overall customer base, using Customer Cohort Charts (see our previous post on this topic) to visualize the full set of dynamics within and across cohorts. By combining perspectives from the full set of lenses, this view offers clear diagnostics about the profitability profile for the entire enterprise.

CBA is particularly useful for answering questions about customer retention trends, differences in recent versus past customer behavior, and the stability of revenue growth. By breaking down revenue into customer cohorts, CBA provides a clearer picture of whether a company’s growth is stable and scalable or if it’s driven by a transient customer base. This enables investors to make informed decisions about the true value and potential of an investment.

Another common example comes with identifying high-value customer segments. A CBA could reveal that a small subset of highly loyal customers is responsible for a disproportionate amount of revenue. Recognizing this allows investors to strategize more effectively – perhaps by investing in customer experience initiatives that strengthen these relationships or even finding new ways to convert occasional buyers into loyal ones. These strategic opportunities often determine whether a private equity acquisition can be a success story or a costly mistake.

Example

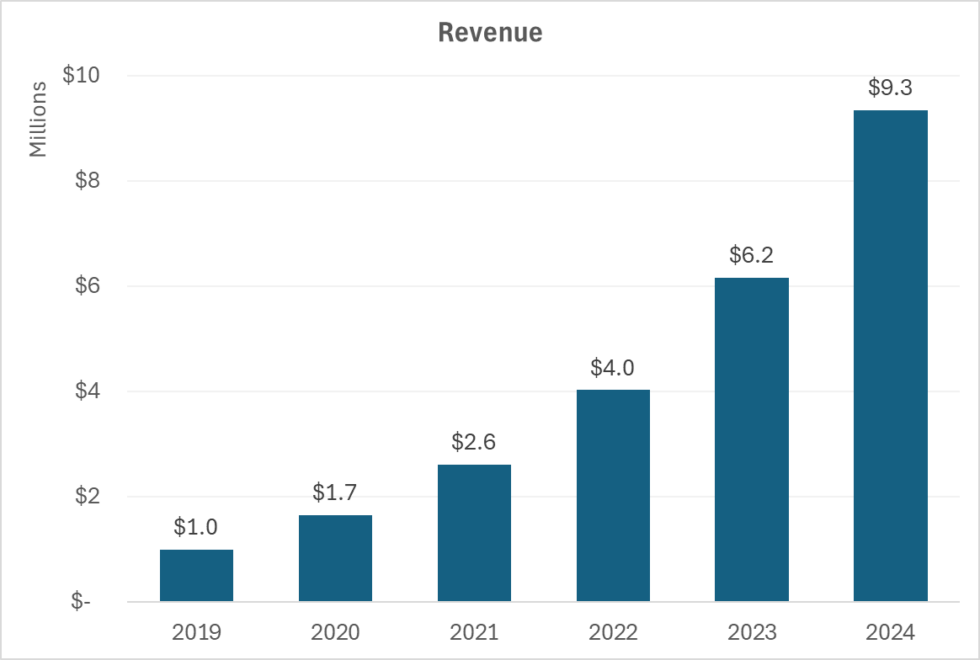

Imagine this scenario: you’re considering an investment in a specialty retail company that has demonstrated impressive growth in revenue over the past five years. The financials look great – strong double-digit year-over-year revenue growth and expanding market share.

A traditional financial-based due diligence approach would suggest that the company is doing great: growth is impressive and steady – the future looks bright! However, a Customer-Base Audit would reveal a more nuanced picture. By breaking this chart down into customer cohorts, CBA might expose that the growth has largely come from aggressive marketing tactics that brought in a surge of one-time buyers, with very few making repeat purchases. Instead of steady, loyal growth, the customer base has become saturated with ‘one-and-done’ purchasers who aren’t sticking around – suggesting that the growth isn’t sustainable, a fact masked by the top-line revenue numbers.

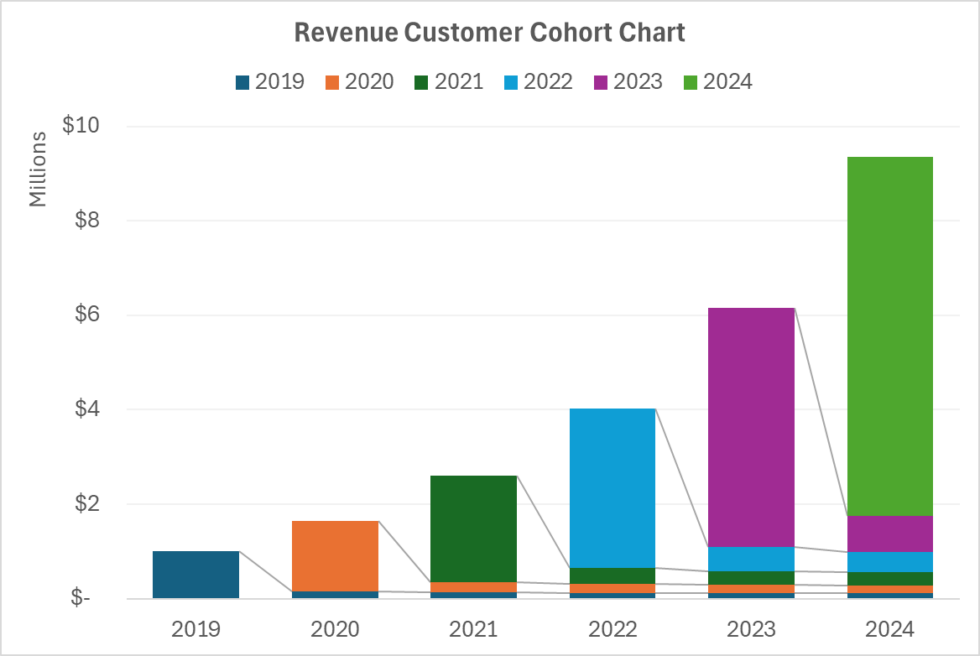

In contrast, a company with the same annual revenue may have a drastically different cohort revenue breakdown. In the example below, CBA reveals growth supported by a solid base of repeat customers, indicating a sustainable model. Rather than relying on short-term gains from new customers, the company is building lasting relationships, evidenced by steady, recurring purchases. This suggests that revenue growth is driven by a loyal customer base, providing a stable and sustainable revenue stream.

Which of these two companies would you invest in? Such insights can reveal whether that upward trend in revenue is built on shaky foundations or if there’s a truly scalable, loyal customer core driving it.

This is just one of many ways CBA can offer insight into the quality of a target company’s health. Additional questions include: How is revenue retention evolving across different cohorts? Are recently acquired customers behaving differently from those acquired in previous years? What factors drive these changes? And many more.

When is the Customer-Base Audit the Right Tool?

The Customer-Base Audit is invaluable when time or budget constraints make an in-depth, forward-looking analysis impractical, especially during early due diligence. It’s an efficient way to gauge customer health and revenue sustainability by analyzing historical behavior patterns. Investors can use CBA during early diligence or when preparing for an exit to showcase customer loyalty and retention strength, providing potential buyers with insights into the stability and resilience of revenue streams. Beyond private equity, corporations can leverage CBA to understand shifts in their customer base, refine retention strategies, or evaluate the long-term impact of marketing investments. Overall, CBA offers a versatile, high-value approach for any organization seeking a clear view of customer dynamics without a full CLV analysis.

Furthermore, while CBA is a natural early step in the due diligence process, it still leaves the door open for a more formal forward-looking CLV analysis in the later stages. There is a powerful “one-two punch” that starts with using the CBA to identify overall health and key behavioral patterns then seeing how these behaviors will likely play out over the longer term. But whether or not the private equity firm plans to take this deeper dive, a CBA is always a good starting point.

Are you ready to see how the Customer-Base Audit can strengthen your investment process or jumpstart a journey to customer centricity? Contact us today to learn more.