FAQs: Customer-Based Value Analysis

The following are some of the most frequently asked questions Theta receives regarding our proprietary customer-based value analysis methodologies, including Customer Lifetime Value (CLV) and Customer-Based Corporate Valuation. Check back often as we continually update this information based on input from our clients.

Customer-based corporate valuation (CBCV) is the process of valuing a company by forecasting current and future customer behavior using customer data in conjunction with traditional financial data.

The CBCV framework consists of two parts:

- A general corporate valuation framework, such as asset valuation, historical earnings valuation, relative valuation, future maintainable earnings valuation, and discount cash flow valuation

- A process through which customer behaviors are incorporated into the general corporate valuation framework

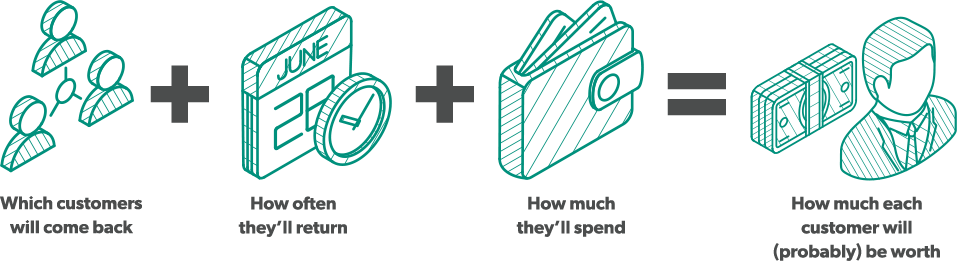

CLV is a prediction of each customer’s profitability over their entire (past and future) relationship. The calculation looks like this:

CLV equals the present value of the cash flows that a customer generates while engaged with the firm minus the cost to acquire the customer. It’s used to predict all the value a business will derive from its entire relationship with a customer.

CBCV takes the core ideas from CLV and applies them to an entire company, in essence tying the value of a company’s customer base to its overall financial valuation.

The use of CBCV:

- Allows investors to build a model, based on the drivers of customer value from the bottom up, that generates a directionally accurate valuation. (Our models have proven to be accurate within 5%.)

- Enables investors to assess what expectations for the drivers of customer value are priced into a company’s stock price.

- Can be used to gauge what the market expects from a business in terms of customer growth and penetration and to understand what share of a business valuation comes from existing users vs future users.

- Allows for tracking and measuring the performance of a business on a quarterly or an annual basis in a way that isn’t captured in the typical accounting statements.

- Better captures the realities of a business such as increasing CAC as penetration goes up.

The CBCV model has incredible value for both investment firms and corporations, but in different ways ─ and depending on the information used in the model.

CBCV enables investment firms to leverage deeper customer value insights during every stage of the investment process: due diligence, portfolio operation, value creation, and exiting a company.

For example, at the due diligence phase, CBCV provides more in-depth insights into a target company’s customer quality, existing revenue stream stability, and levers to improve the value of new revenue streams. In turn, this information enables investment firms to identify customer “red flags” early, better forecast things like customer acquisition and retention, and much more.

Using CBCV, companies can more accurately predict customer retention, repeat purchasing, and spend. This enables them to better understand the current and future health of their customer base, identify opportunities to improve customer value, and translate customer value into the overall company valuation (CBCV).

This knowledge can be extremely valuable to companies, whether they’re seeking a competitive advantage, raising capital, or want to improve M&A terms.

The CBCV method is agnostic to the input data used for training the model. However, investment firms and corporations have access to different kinds of data. For example, investment firms typically only have access to publicly disclosed data. Corporations, however, can access internal information that typically isn’t made available publicly and can provide more granular insights into customer behavior.

Investment firms and corporations also have different needs and expectations of the information and insights the CBCV models generate. Both want to know as much about the customer base as possible. The investment firm’s interest is more in terms of the health and value of that customer base for purposes of determining a company’s value. Corporations are usually more interested in using customer behavior insights to implement strategies that enable them to better exploit and grow customer value.

The methodology works whether the company features a predictable, subscription-driven revenue stream or a base of active customers who place discretionary orders.

Companies that rely primarily on subscriptions tend to be easier to model because the key determinants of value are generally explicit. This includes Software as a service (SaaS) companies, and movie and music streaming businesses. The drivers for non-subscription companies can be more difficult to assess, such as customer retention, the pace of repeat purchases, and the size of orders.

Most financial valuation methods require quarterly financial projections, most notably of revenue. Recognizing that every dollar of revenue comes from a customer who makes a purchase, CBCV exploits basic accounting principles to make revenue projections from the bottom up instead of from the top down.

Just like other methods of valuation analysis, the goal of CBCV is to estimate the present value of a business’ free cash flow and therefore the valuation. The difference with CBCV is that it determines the value at a customer or user level, and then scales that up to the total number of customers to determine the overall value of a business.

In addition to financial statement data, a CBCV requires:

- A customer base model

- Customer data to feed the model

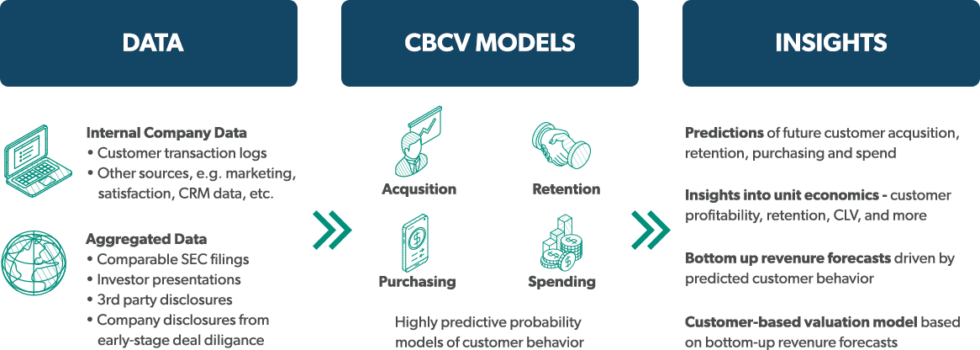

A customer base model consists of four sub models that provide insights into how each of a company’s customers will behave. They are:

- Customer acquisition model, which forecasts the inflow of new customers

- Customer retention model, which forecasts how long customers will remain active

- Purchase model, which forecasts how frequently customers will transact with a company

- Basket-size model, which forecasts how much customers spend per purchase

Together, these sub models produce much more precise estimates of future revenue streams. This, in turn, can yield better estimates of what a company is really worth.

A variety of information can be used in a CBCV, but among the most important are:

- Behavioral data

- Demographics

- Transactional data or summaries thereof (e.g., the customer cohort chart or C3)

- CRM data

- Length of contracts, periodic payments, and observable churn (for subscription companies)

- Timing and size of each individual purchase (non-subscription companies)

- Marketing touchpoints

- Service interactions

A customer cohort chart, also called a C3, tracks revenue by acquisition cohort over time. It shows how total customer spending changes as each cohort ages. A C3, along with the number of active customers and the total number of orders, can provide a good understanding of customer behavior. Increasingly, subscription and non-subscription companies disclose their C3. However, C3s are mostly likely to be included by IPOs in their S-1 filings.

- Acquisition. It is very important to know how much of a company’s business is coming in from new customers in a particular year because this information has implications regarding future reliance on new customer acquisition.

- Churn. Sales over time provides a good indication of revenue retention rate and repeat business.

- Heterogeneity. How different customers are from one another is important for two reasons:

- Companies with a high degree of customer heterogeneity have more opportunities to create value through customer-centric initiatives, building their businesses around the needs of the most valuable customers.

- Companies with more heterogenous customer bases are more likely to be undervalued by those using more traditional approaches.

Three to four years of information should be sufficient for running a CBCV model and assessing the overall health of a company’s customer base. However, the more years of information you can use, the better the insights you’ll gain regarding future revenues.

Ideally, you want to collect the following:

- Total number of active customers

- Percentage of active tenured customers or customers who have been with the company for at least 12 months

- Gross acquired customers over the most recent period

- Total revenue

- Percentage of revenue

- The total number of orders

- Percentage of orders

The information may be found by going through a company’s SEC filings or other public disclosures. It also may be made available upon request. In addition, some third-party data providers may be able to provide information.

The CBCV frameworks employed by Theta are agnostic to the input data used for training models. Even if a firm discloses only a small amount of customer data, Theta has the model-building and computational skills to squeeze the most value out of a limited dataset.

Simulators are available on the Theta web site that allow you to input information on customer acquisition, churn and repeat purchasing, and spend to generate financial assumptions for two companies: Warby Parker and Farfetch.

There are several benefits to using a third-party company like Theta. First, there are all the benefits that come from outsourcing such as freeing up internal resources and leveraging expertise that might not be available in-house. It also doesn’t require investment in software or other tools.

There are many good firms out there that can provide valuable assistance in helping companies understand customer behavior. However, Theta offers some very specific benefits that most other companies can’t offer.

First, Theta’s co-founders Peter Fader and Dan McCarthy are considered leading experts in customer value models and methodologies, including CBCV. (Because of their work in this area, they hold the trademark on the CBCV framework.) Both teach the topics, and write and speak on them extensively. They’ve also demonstrated the success of their work in the corporate world with the CBCVs they conduct, as well as by the sale of their previous consumer analytics firm to Nike in 2018. Both are extremely hands on in all aspects of the services Theta delivers.

Additionally, Theta’s team of data scientists, software engineers and other professionals go beyond what internal analytics team can typically do. They are able, using Theta’s particular application of the CBCV model, to predict value over very long horizons (5-15 years), and decompose revenue into its four components (acquisition, retention, repeat purchase and spend) to understand key drivers of performance. The team will often do ‘what if’ scenarios using a proprietary-built valuation simulator and can account for seasonality and demand shocks within the analysis.

Finally, Theta’s services are customized to each client’s specific needs.

If you have additional questions, Theta has the answers. Submit your questions to us for possible inclusion in our next round of FAQs. Or contact us to discuss how we can put a CBCV to work for you.

You can also download these FAQs to reference later or share with a colleague.

NEWSLETTER SIGN-UP

Sign up for the Centricity Newsletter

If you’re not already getting exclusive Centricity content delivered to your inbox, sign up to do so now. Check out our most recent Centricity email newsletter to preview the exclusive content you get when you sign up for Centricity.

Do you have any suggestions for content you’d like to see featured in the monthly Centricity newsletter? Let us know. Use the Ask Theta form.