VIP Customers: How to Find Them and Why

VIPs. Top customers. Most valuable customers. Premier customers. Elite customers. Whatever you choose to call them, they’re the customers that contribute the most value to your business (or, if you’re a private equity firm, the business you’re assessing or creating value in.) They should also be the focus of any customer experience, loyalty, retention, and/or acquisition programs ─ at the heart of a customer-centricity strategy.

Customer Centricity and VIP Customers

As defined by Wharton professor, author and Theta co-founder Peter Fader, a customer-centricity strategy is one “that aligns a company’s development and delivery of its products and services with the current and future needs of a select set of customers in order to maximize their long-term financial value to the firm.” That “select set” of customers are the VIP customers.

They spend the most money with the company, make frequent purchases, spend a lot on each purchase, and generate the highest profit for the business. Out of loyalty to the company or brand, they may also generate valuable social proof, advocate for the business, and/or frequently refer others to the business.

That’s not to say other customers aren’t important. They’re just not as important. According to McKinsey & Company, VIPs make up 1-10% of a company’s customers but represent 20-50% of total revenue ─ 10-25 times that of the average customer. Our research here at Theta similarly suggests that 20% of the customers make up about 65% of revenue. Many companies use the Pareto principle instead, with the idea that 20% of customers account for 80% of a company’s revenue. Either way, a small percentage of customers offer companies greater value.

How to Find the VIPs

There are many recommendations for developing, retaining, and catering to VIP customers, including delivering stellar customer experiences and implementing well-researched customer loyalty programs. But the first step is to identify those top-tier customers. According to Fader, the key to doing that is to segment customers based on their value ─ precisely, their future-looking customer lifetime value (CLV).

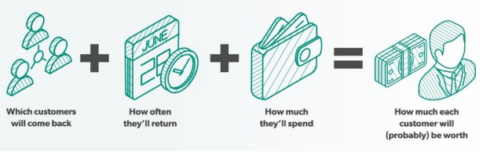

CLV estimates the total amount of money a company receives from a customer during the entire engagement time before the customer churns. The idea is to segment customers based on what they will be worth to the firm in the future. Those that will provide the most significant value are the VIPs.

The basic CLV formula looks like this:

But “basic” typically isn’t enough. And while historical data is essential, it doesn’t provide a forward-looking view into the value of the customer base, and other factors may come into play:

- The kind of business setting the company is in (contractual or non-contractual)

- Customer heterogeneity

- The cost of acquisition and the likelihood that different kinds of customers are going to stay with the company

- How often a customer makes a purchase and the amount spent

- Customer lifespan (before churn)

- How a customer generates value in ways other than direct purchases, such as social proof or referrals

- Customers who fall just short of “VIP status” but have the potential to get there.

The model used also matters. Some models offer a more general CLV number. That’s the case with aggregate models, which use a constant spend rate and churn for all customers. Others, such as probabilistic models ─ Pareto/NBD and BG/NBD, for example ─ employ additional data and more robust algorithms to generate a more granular view of customers. Read Theta’s eBook, Important Lessons for Embracing Customer Lifetime Value, for information on the benefits and challenges of different models. There’s also a two-part blog series with more information on CLV models and the use of covariates. The July issue of Theta’s newsletter Centricity also details this topic. The potential complexity in choosing and running the correct models makes a strong case for working with third-party companies that are well-versed in using various models. The best are also at the forefront of continuously evolving those models to account for the nuances in customer behavior.

What to Do with VIP Customer Information

Once VIP customers have been identified, companies are better positioned to keep them happy. Retaining the best customers may cost more than retaining so-called “average” customers, but as the research demonstrates, the payoff is worth it.

Companies can also use the information to guide efforts to acquire more customers like VIPs. And if a particular group of customers has decreased in value, CLV can be used to identify the highest-value individuals to reactivate within that group.