Accuracy Pays: How Inaccurate CLV Models Hurt Your Bottom Line

December 2023

In a previous post, we explored the fact that not all CLV models are created equal and the significant role this plays in achieving high accuracy in CLV calculations. For those who followed that discussion, it became clear that having a nuanced CLV model can help better capture the reality of a company’s business and more accurately predict future customer behavior. Yet, there’s an essential question we haven’t fully addressed — what is the real dollar value of getting your CLV model right?

Before we dive in, let’s establish clear definitions to ensure we’re on the same page about what CLV represents. CLV is the net present value of all profits and costs – including customer acquisition cost (CAC) – associated with a customer over the full lifetime of that customer. As such, CLV provides a comprehensive view of a customer’s total value to a company. In contrast, post-acquisition value (PAV) is the net present value of a customer after acquisition (i.e., before deducting CAC). It gives us an upper bound for what a company should ideally invest in acquiring a customer. This ceiling is often represented as a multiple of CAC, or a target PAV-to-CAC ratio. Although CLV/LTV and PAV are sometimes confused with one another, it’s important to distinguish the one from the other because including or excluding CAC will lead to large changes in valuation and use case. In this post, we are specifically delving into the implications and costs associated with inaccuracies in a PAV model.

Understanding and accurately measuring the level of PAV – and not just the rank ordering of customers by PAV or some sort of score-based measure – is crucial for companies aiming for sustainable growth. It’s not just about identifying the most profitable relationships; an accurate PAV model ensures that the company invests the right amount of resources in acquiring, retaining, and developing customers, avoiding the pitfalls of inefficient campaigns. This accuracy extends beyond marketing, fostering more accurate customer-based revenue forecasts and leading to optimal resource allocation throughout the company.

Consider the impact of PAV (and thus CLV) accuracy on various aspects of customer relations, like acquisition, retention, and development. In each of these use cases, there’s an optimal spend that brings about the desired ROI and total value created through a marketing campaign. For instance, underinvesting in a customer retention campaign, such as offering a smaller discount, can result in a less appealing offer with a smaller proportion of those targeted using the discount, ultimately reducing ROI and missing out on potential profits. On the other hand, overinvesting, like providing too large a discount, might increase the proportion of people who utilize the discount but at the expense of overspending on each customer, diminishing the overall campaign value and potentially even leading to value destruction. An accurate PAV model is essential to find this sweet spot, ensuring optimal spending in all customer-related activities. Without this accuracy, there’s a risk of misallocating resources, reducing marketing ROI, and eroding customer value.

But how can we quantify the cost of this inaccuracy in dollars? Let’s consider a few examples.

Customer acquisition

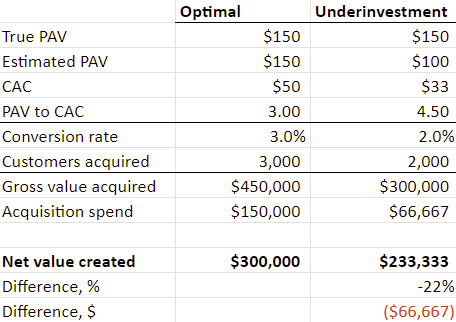

One critical application of PAV is guiding how much to invest in acquiring new customers, typically informed by the PAV to CAC (Customer Acquisition Cost) ratio. Let’s consider a fast-growing online retailer heavily investing in new customer acquisition. If your actual average PAV is $150, but your model underestimates it at $100, this leads to underinvestment in acquisition efforts, constraining growth and missing profitable revenue opportunities. For example, aiming for a 3x PAV to CAC ratio, you launch a campaign to reach 100,000 prospects. With the correct PAV, you’d target an allocation of $50 per new customer ($150 / 3 = $50) for acquisition. Imagine that this $50 offer for new customers is taken by 3% of the 100,000 prospects that you had sent the new customer offer out to (i.e., the conversion rate is 3%). Then targeting 100,000 prospects leads to 3,000 new customers and a $150,000 total acquisition cost (100,000 prospects x 3% conversion x $50 CAC). These customers are projected to bring $450,000 in long-term value (3,000 new customers x $150 PAV per customer), yielding $300,000 in total value created after acquisition expenses from this campaign at the desired marketing ROI of 200% ($150 PAV minus $50 CAC, divided by $50 CAC).

With the underestimated PAV, that target 3x PAV to CAC ratio implies that you would allocate only $33 per new customer ($100 / 3 = $33), implying that you would try and reach those prospects through lower quality channels, and/or offer a less appealing offer for those prospects to adopt. This reduced investment will have you leaving money on the table. Fewer of those 100,000 prospects will take you up on the offer, because the offer is less attractive. Imagine that the proportion of prospects who take the less attractive new customer offer falls from 3% to 2%. Then you end up attracting only 2,000 customers with total PAV value created of $300,000 (2,000 acquisitions x $150 PAV), total customer acquisition cost of about $66,000 (2,000 acquisitions x $33 CAC per customer) and thus $234,000 in total value created, which is 22% lower than with an accurate model (albeit at an overly conservative marketing ROI). The direct cost of this inaccuracy amounts to almost $70,000 for just one campaign. When extrapolated across your entire acquisition budget, the revenue shortfall will be substantial.

Similarly, if you were to overestimate PAV, you would spend too much on customer acquisition, leading to a marketing ROI that is lower than target (and, if the overestimation were big enough, less than zero!).

Customer retention

Exactly the same principles apply when we turn our attention from customer acquisition to customer retention. It is important to note that in the domain of customer retention and development initiatives, it’s more appropriate for companies to use the RLV (Residual Lifetime Value) metric, rather than PAV. The key distinction with RLV lies in its exclusive focus on the future value of a customer. Specifically, RLV assesses the anticipated profits a customer will generate over the remainder of their relationship with the company. This approach is particularly relevant in retention strategies, where the historical value a customer has already provided is sunk. Considering that RLV is, roughly speaking, the difference between PAV and the known historical value of a customer, the accuracy of RLV is fundamentally tied to the accuracy of PAV. This makes model accuracy in terms of PAV crucial not only for its own sake but also for obtaining a trustworthy RLV, which is vital for effective customer retention and development strategies.

Consider a company with a substantial segment of loyal high-value customers, where retention efforts could improve their RLVs. Let’s imagine you are running a campaign to retain and reactivate customers who are at risk of churn. You are going to send an offer (say, a discount) to a segment of customers you identified as high risk with high value potential (something that a PAV model will be able to help with). You expect that some customers who accept the offer might continue their relationship with the company and generate additional value, and that this value would outweigh the cost of discounts.

The same “sweet spot” principle applies here as well: if you spend too little on customer retention, your uptake rate will be too low, leading to a marketing ROI that is overly conservative and total value creation through the retention campaign that is too low. Conversely, if you spend too much, the attractiveness of the retention initiative and the uptake rate might be too high, leading to a marketing ROI that is less than target (and possibly even negative). The campaign may be different, but the underlying calculations and conclusions are exactly the same – an accurate model for PAV (and thus RLV) is absolutely critical. In summary, the accuracy of your PAV model is not just a technical detail; it’s a fundamental driver of financial health and strategic direction. We have shown that inaccurate PAV and RLV calculations can result in either underinvestment or overinvestment, leading to value creation that is less than it should be (and potentially even negative). This is true for both acquisition and retention campaigns.

These examples underscore the critical need for accurate CLV models. Inaccuracy in measuring customer value is not an anomaly — differences as big or even bigger than those shown above are highly common. These issues are particularly severe for younger cohorts — customers who have been recently acquired — due to the limited transactional data available for them. This group is especially important because they are most reflective of the value of the customers you are acquiring today — the ones that you need PAV for to get the right upper bound for CAC in the first place!

The real cost of PAV inaccuracy manifests not only in immediate financial losses but also in long-term financial performance. It can drive down the trajectory of your growth, customer base, and/or profitability. For companies looking to thrive in competitive markets, ensuring the accuracy of their PAV models is not just a best practice – it’s an imperative. The stakes are high, and the difference between an accurate and an inaccurate PAV model can be the deciding factor in achieving sustainable growth and market leadership.