Slack’s Fair Equity Valuation: $22-27B With Upside Potential

Lyft and Uber’s stocks have performed very poorly post-IPO (Lyft down 30% from its IPO price, Uber down 12% as of May 14, 2019). They have performed so poorly, in fact, that many popular media outlets are claiming IPO markets in general have been “poisoned” by these firms. Investors are wondering if this means companies that are lossmaking before their IPOs will all face similar struggles now – if so, Slack would have trouble getting a high valuation because it is certainly losing money. And unlike Uber, Slack won’t have underwriters supporting its stock through covered naked short positions because it is going public through a direct public offering (DPO) instead of an IPO.

In our previous article about Slack, we assessed the firm’s unit economics by analyzing customer data from its pre-DPO filing. We concluded that it has very strong customer profitability (more than 1,000% marketing ROI), even though it takes about 3 years on average to pay back the initial investment in customer acquisition, and much of the value will be coming from just 1% of the customers they acquire. In contrast, we estimated Lyft’s return on CAC at a much lower ~60% (we couldn’t perform a similar analysis on Uber because they chose not to disclose critical customer metrics such as cohort-level repeat usage or customer acquisition data).

It makes intuitive sense that Slack’s strong CLV numbers should be directionally positive for their valuation, and in this post, we show exactly how by translating these figures (or rather, the underlying customer-level predictions that generate them) into an estimate of the fair valuation of Slack’s equity using our Customer-Based Corporate Valuation (CBCV) approach. We take the model that we fit in our last post and use it to project what future customer acquisitions will be, the stream of revenue we can expect from those customers after they have been acquired, how that revenue will flow through into variable profits, and how much of that variable profitability the firm will be able to keep after deducting fixed costs.

Cutting to the chase, our results suggest that Slack’s fair valuation is $22-27B with further upside potential. At the level of more recent private market transactions, which valued the firm at nearly $17B, our estimated valuation represents a 30-60%+ upside opportunity. This strong valuation is primarily justified by the very strong retention profile of each cohort of acquired customers, and Slack’s solid ability to expand its relationships with those customers over time.

Valuation model and assumptions

To convert the customer value insights that we discussed in the last post into overall fair valuation estimates, we first combine the customer behavior models (acquisition, retention, and spend) to generate future revenue forecasts. Then we use a traditional discounted cash flow valuation model to estimate the fair valuation of the company’s equity.

A few comments on these assumptions are worth mentioning for context:

Weighted average cost of capital (WACC). Slack’s capital structure is 100% comprised of equity, and comparable SaaS firms have equity cost of capital ranging from 9.5% to 14%, averaging to 10.4% (source: Bloomberg). Therefore we assume, rather conservatively, that Slack’s WACC is 12%. We should note that since Slack’s customers are very long-lived with back-end loaded monetization profiles, the majority of the firm’s value is coming from future periods, making Slack’s fair valuation estimate highly sensitive to WACC, as we will see in the valuation results below. But considering Slack’s highly stable and predictable future cash flows, Slack could reduce its WACC well below this level through a reversion of WACC to that of its peers, and even further still through debt financing.

Revenue expansion horizon. As we mentioned in our previous post, we assume that cohort revenue expansion stops – not slows down, but rather completely flat-lines – 7 years after customers are acquired. We believe this is reasonable (if not conservative) because we see no signs of within-cohort revenue expansion slowing down in the observable data, even 5 years after customer acquisition. Even if monetization were to slow down after 5 years, it stands to reason that growth could continue at a slower rate for quite a while beyond the 7 year point on average. However, as new data comes in, we would closely monitor this important dynamic.

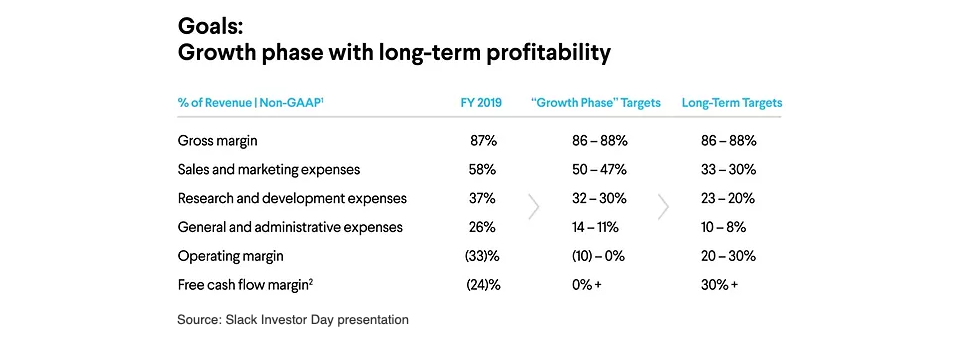

Long-term margins. We used Slack management’s mid-point estimates of long-term target margins that they presented during the Investor Day on May 13, assuming they will be realized 7 years from now.

Even though we treat a portion of R&D and G&A expenses as fixed costs in the short run, for valuation purposes we model them as a percentage of revenues as it is often done in the DCF valuation, essentially treating them as variable costs in the long run.

Total addressable market (TAM). We assume 5.4M prospects (businesses) worldwide based on Slack’s TAM estimate of $28B and dividing it by Slack’s FY2019 average revenue per customer of ~$5,200. While this is undoubtedly a rough estimate, our valuation is not very sensitive to this assumption (more on this in the valuation results).

Non-financial working capital. One of the benefits of the SaaS business model is positive cash flow dynamics. Firms like Slack tend to get paid in advance and then incur expenses to provide related services later, boosting free cash flow and lessening or removing completely the need for additional financings which may be dilutive to current shareholders. Right now, Slack’s non-financial working capital as a percentage of sales is -43%. We expect it will settle down to -35% in the long run, consistent (or even conservative) relative to peers such as Salesforce and Atlassian.

Valuation results

Under the baseline assumptions outlined above (12% WACC, 7 years of revenue expansion for each cohort, and achieving long-term margins in 7 years), our fair value estimate of Slack’s equity is $22.4B, or 30% above its valuation in recent private market deals.

In the upside scenario, assuming that Slack’s WACC goes down to 11% (for example, due to debt financing, or due to reversion to the midpoint of its peer set), this valuation goes up to $26.9B or almost 60% above the most recent valuation (higher still if Slack’s WACC moves down to 10%). If WACC was equal to the average of its peer set at 10.4%, its fair valuation increases further still to $30B.

In the downside scenario, assuming that it takes Slack 10 years to achieve the long-term margins, our fair value estimate is $20.6B. If TAM ended up being one half or one third of our estimate, Slack’s fair valuation would be $20.1B or $18.4B, respectively. Finally, if we assume that Slack achieves only the bottom of the operating margin range in the long run, Slack’s fair valuation would be $18.6B. We would need to see a much sharper weakness in TAM and/or margins to fall well below Slack’s valuation recently. This is certainly possible, but it is also possible or even likely to see the valuation upside if the base case scenario were to be realized, as WACC would presumably fall in line with the peer set as the business matures.

Since the firm’s target valuation has not been made public yet, we don’t know what this implies for the attractiveness of their stock post-DPO. That being said, it is very heartening that under all the scenarios we’ve presented above, our estimate of Slack’s fair value lies above the most recent private valuation of $17B – the same certainly could not be said for Uber or Lyft, as measured by their post-IPO stock price performance. We will continue to watch this story with interest and will let you know as we get closer to the big day.

May 16, 2019

Peter Fader is the author of “The Customer Centricity Playbook” and a co-founder of Theta Equity Partners. Daniel McCarthy is a co-founder and Val Rastorguev is a Director of Theta Equity Partners, a company specialized in customer-based corporate valuation — valuing firms by forecasting what their current and future customers will likely do.

This article is for informational and educational purposes only, you should not construe any such information or other material as investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer by Theta Equity Partners to buy or sell any securities or other financial instruments.